The Biggest Tech Bet of 2024

Introduction: The Multi-Trillion Dollar Infrastructure Gold Rush

While headlines in 2023 were dominated by the dazzling public-facing applications of generative AI—the chatbots, the image creators, the coding assistants—a far more consequential and capital-intensive battle was quietly brewing behind the scenes. As we move deeper into 2024, it has become unequivocally clear that the single biggest tech bet is not on any specific AI model or consumer app, but on the foundational computing infrastructure required to power the entire AI revolution. This is a multi-trillion dollar wager being placed by every major tech giant, sovereign wealth fund, and venture capital firm on the planet. The bet is simple: that the demand for AI compute—the raw, processing power needed to train and run massive models—will be insatiable for the foreseeable future, growing at a rate that will eclipse even the most optimistic projections. This isn’t a gamble on a single company’s success, but on the very plumbing of the next technological era, creating a historic opportunity that dwarfs the cloud and mobile revolutions combined.

A. The Core Thesis: Why Infrastructure is the Ultimate Bet

The logic behind this monumental bet is rooted in a fundamental and self-perpetuating cycle of AI advancement.

A. The Scaling Law Paradigm: Empirical research has consistently shown that the performance of AI models scales predictably with three key inputs: the size of the model (parameters), the quantity and quality of the training data, and the amount of compute used. To achieve the next leap in capability—from GPT-4 to GPT-5 and beyond—requires an exponential increase in computing power. There are no known shortcuts; more intelligence demands more silicon and more electricity.

B. The Shift from Training to Inference: The initial phase of the AI boom was dominated by the one-time, albeit massive, compute cost of training foundational models. The bet for 2024 and beyond is on the inference phase—the ongoing cost of running these models for billions of users around the world. Every query to ChatGPT, every image generated by Midjourney, and every AI-powered feature in a software application consumes inference compute. This creates a recurring, usage-based revenue stream that is potentially limitless.

C. The “AI as a Utility” Vision: The long-term vision is that AI will become a utility, as essential and ubiquitous as electricity or broadband internet. The companies that own and operate the “power plants” for this utility—the data centers and the chip supply chain—will occupy the most valuable and defensible positions in the new economy, akin to how oil companies powered the 20th century.

B. The Key Battlefronts: Where the Bets Are Being Placed

The infrastructure bet is not a single monolithic investment but a coordinated assault across multiple, interdependent layers of the technology stack.

B.1. The Silicon Layer: Beyond NVIDIA’s Dominance

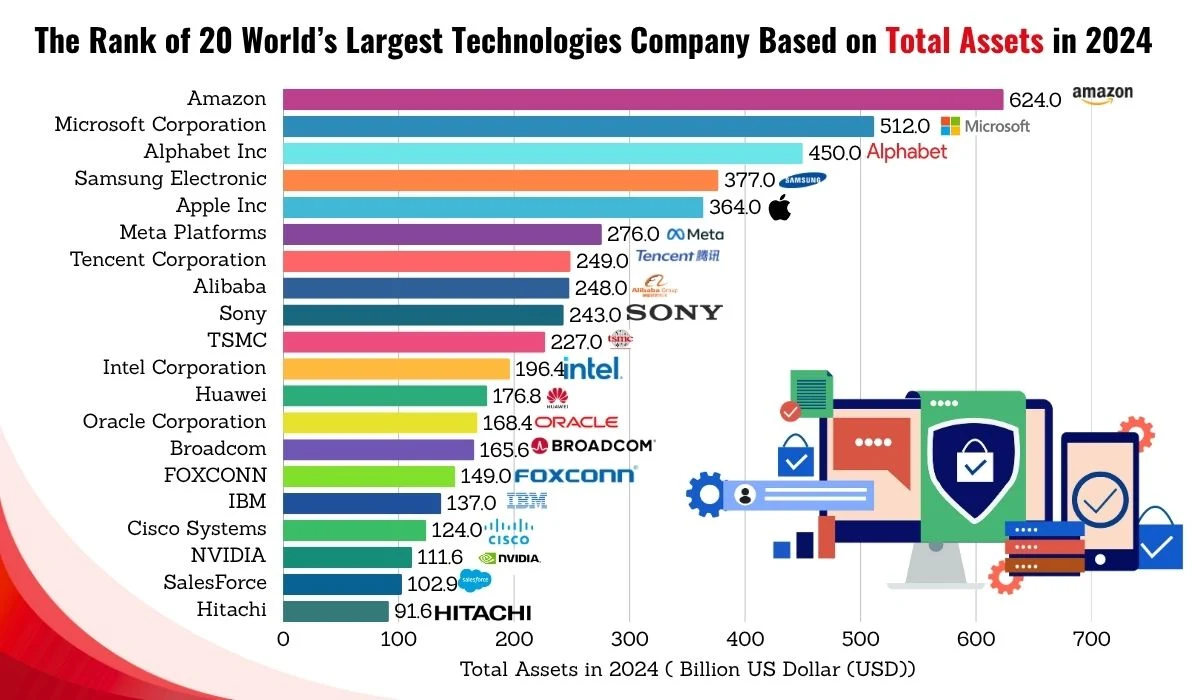

NVIDIA’s meteoric rise to a multi-trillion dollar company has been the most visible manifestation of this trend. Their H100 and new Blackwell GPUs have become the de facto standard for AI training. The bet here is multi-faceted:

A. NVIDIA’s Continued Execution: Investors are betting that NVIDIA can maintain its technological moat, fend off competitors, and continue to sell its complete stack (chips, networking, software) at premium prices.

B. The Challenger Ecosystem: A massive bet is simultaneously being placed on challengers who can capture a piece of NVIDIA’s monopoly.

* AMD: With its MI300 series accelerators, AMD is making its most serious push yet, betting that its open software ecosystem and competitive performance can lure cloud providers seeking a second source.

* Custom Silicon (ASICs): The biggest tech giants are making the ultimate vertical integration bet by designing their own chips. Google’s TPU is on its fifth generation, Amazon AWS has its Trainium and Inferentia chips, and Microsoft is reportedly developing its own AI silicon. This is a bet on cost savings, performance optimization for specific workloads, and strategic independence.

C. The Memory and Networking Bottleneck: Advanced AI requires not just powerful processors, but immense bandwidth for memory (HBM – High Bandwidth Memory) and lightning-fast interconnects (like InfiniBand) to link thousands of chips together. Companies like Broadcom and Marvell are seeing huge bets placed on them as critical enablers of AI supercomputing clusters.

B.2. The Data Center Layer: The AI Factory

The classic cloud data center is being re-architected into what is now called an “AI factory”—a purpose-built facility designed for a single task: processing AI workloads.

A. The Power Density Crisis: A traditional cloud server rack might draw 5-10 kilowatts of power. An AI server rack with multiple H100 GPUs can draw 40-100 kilowatts. This necessitates a complete overhaul of power delivery, cooling (moving from air to liquid cooling), and physical footprint. The bet is on companies that can build these next-generation facilities at scale and with speed.

B. The Geographic and Energy Arbitrage: With AI data centers consuming as much power as small cities, their location is now a strategic decision. Bets are being placed on regions with cheap, abundant, and sustainable energy sources, such as the American Midwest (wind), Scandinavia (hydro), and the Middle East (solar). This is fueling a boom in nuclear, fusion, and other advanced energy investments.

C. The Rise of Specialized Providers: While the “hyperscalers” (AWS, Azure, Google Cloud) are building furiously, a new class of provider is emerging. Companies like CoreWeave and Lambda Labs have raised billions by focusing exclusively on providing raw GPU compute on demand, betting that they can be more agile and cost-effective than the giants.

B.3. The Software and Model Efficiency Layer

As the hardware costs soar, a parallel bet is being placed on software that can make the entire system more efficient.

A. Model Compression and Quantization: Startups and research labs are betting on techniques that can shrink large models to run faster and cheaper on less powerful hardware without a significant loss in capability, thereby expanding the market for AI inference.

B. AI Orchestration and Management: The software that manages, deploys, and monitors thousands of AI models across a global fleet of GPUs is becoming a critical layer. This “Kubernetes for AI” is a major investment area, with companies like Anyscale and Baseten raising significant capital.

C. The Financial Tsunami: Tracking the Capital Flow

The scale of capital deployment into AI infrastructure is unprecedented in the history of technology.

A. Capex Announcements: The most telling signal is the projected Capital Expenditure (Capex) from tech giants. For 2024, Microsoft, Google, and Meta have collectively guided for over $140 billion in Capex, primarily for AI infrastructure—a staggering increase from previous years. This is a direct, public bet on future AI demand.

B. Venture Capital and Private Equity: Billions are flowing into the infrastructure startups mentioned above. CoreWeave, for instance, has achieved a multi-billion dollar valuation in just a few years, backed by top-tier firms. Private equity is buying up and building data centers to lease to tech companies.

C. Strategic Partnerships and Debts: Microsoft’s multi-billion dollar partnership with OpenAI is, at its core, an infrastructure bet—providing the compute in exchange for access to the model. Companies are taking on significant debt to finance the build-out of their AI data centers, betting that future revenue will far outpace the cost of capital.

D. The Risks and Unknowns: What Could Go Wrong?

A bet of this magnitude is not without its existential risks.

A. The Demand Miscalculation: The entire thesis collapses if the demand for AI applications and services does not materialize as expected. If enterprises struggle to find profitable use cases or if consumer adoption plateaus, the world could be left with a massive overcapacity of expensive, specialized compute.

B. Technological Disruption: The current bet is largely predicated on the continued dominance of the transformer architecture. A fundamental breakthrough in AI research that requires a completely different, less computationally intensive approach could render trillions of dollars of specialized infrastructure obsolete.

C. The Geopolitical Wildcard: The concentration of advanced semiconductor manufacturing in Taiwan (TSMC) and the US-China tech war create immense supply chain fragility. Any disruption could halt the global build-out and expose the vulnerability of this centralized infrastructure.

D. The Economic Sustainability: The astronomical cost of training a single model (estimates for GPT-5 range in the hundreds of millions of dollars) may not be economically sustainable, even for the largest companies, if the returns are not immediate and substantial.

Conclusion: The Bedrock of the Next Decade

The biggest tech bet of 2024 is a clear and unambiguous declaration that we are in the early stages of a decades-long build-out of AI infrastructure. It is a bet on the foundational layer of the digital economy, a belief that AI compute will be the most valuable commodity of the 21st century. The winners of this race will not necessarily be the ones who create the most captivating AI demo, but those who control the means of production—the chips, the data centers, and the power grids that make it all possible.

This bet is reshaping global capital allocation, corporate strategy, and national industrial policy. It is creating new corporate titans and threatening established ones. While the applications of AI will capture the public’s imagination, the real story of this decade is being written in the silent, power-hungry, and unimaginably expensive factories of computation being erected around the world. The infrastructure gold rush is on, and its outcome will determine the balance of power in the tech industry for a generation.