The AI Profitability Puzzle Remains Unsolved

The artificial intelligence revolution is unfolding at a breathtaking pace, captivating global markets and commanding trillions of dollars in investment. Headlines are dominated by breathtaking demos of generative AI that can write sonnets, write code, and create photorealistic images. Beneath this dazzling surface, however, lies a critical and unresolved challenge that will ultimately determine the winners and losers of this technological epoch: the path to sustainable profitability. The AI industry is currently grappling with a multi-billion dollar question that strikes at the very heart of its business model. How can companies build economically viable enterprises when the costs of developing and running advanced AI models are astronomical, the competitive landscape is ferociously crowded, and the very nature of the technology invites rapid commoditization? This is not merely a technical challenge; it is an existential business puzzle that encompasses everything from computational infrastructure and data acquisition to market positioning and long-term customer value.

A. The Staggering Cost Structure of the AI Economy

To understand the profitability challenge, one must first appreciate the immense, multi-layered costs involved in the AI value chain. These are not minor operational expenses; they are capital-intensive investments on a scale rarely seen in technology.

A.1. The Compute Conundrum: AI’s Insatiable Appetite for Processing Power

The foundation of modern AI is built upon a voracious consumption of computational resources, creating a significant financial barrier to entry.

-

Training Costs: The Initial Multi-Million Dollar Bet: Training a single large-scale foundational model, like GPT-4 or similar, is estimated to cost well over $100 million. This process requires running thousands of specialized high-end GPUs (Graphics Processing Units) from companies like NVIDIA for weeks or even months at a time, consuming enough electricity to power thousands of homes. This is a sunk cost with no guarantee of a usable or competitive outcome.

-

Inference Costs: The Perpetual Financial Drain: While training costs are headline-grabbing, the real long-term financial challenge lies in “inference”—the cost of running a trained model to answer user queries. Every prompt sent to ChatGPT or a similar AI service triggers complex calculations across a vast neural network. Serving billions of such queries monthly requires maintaining massive, globally distributed server farms, leading to ongoing expenses that scale directly with usage. Unlike traditional software, where serving an additional user has negligible cost, each AI interaction carries a tangible, non-trivial price tag.

-

The Scarcity and Cost of Hardware: The explosive demand for AI-capable chips has created a supply bottleneck, granting immense pricing power to hardware manufacturers like NVIDIA. This concentration of supply creates a fundamental dependency and a persistent drain on the financial resources of AI companies.

A.2. The Data and Talent Squeeze: The Human and Informational Foundation

Beyond silicon and electricity, AI requires two other exceptionally expensive resources: data and human expertise.

-

The High-Quality Data Hunt: The performance of an AI model is directly correlated with the quality, quantity, and diversity of its training data. Acquiring this data is costly. It involves licensing massive datasets from content publishers, web scraping at an immense scale (which carries legal risks), and employing thousands of human data annotators to label and clean data—a process that is both labor-intensive and critical for model accuracy.

-

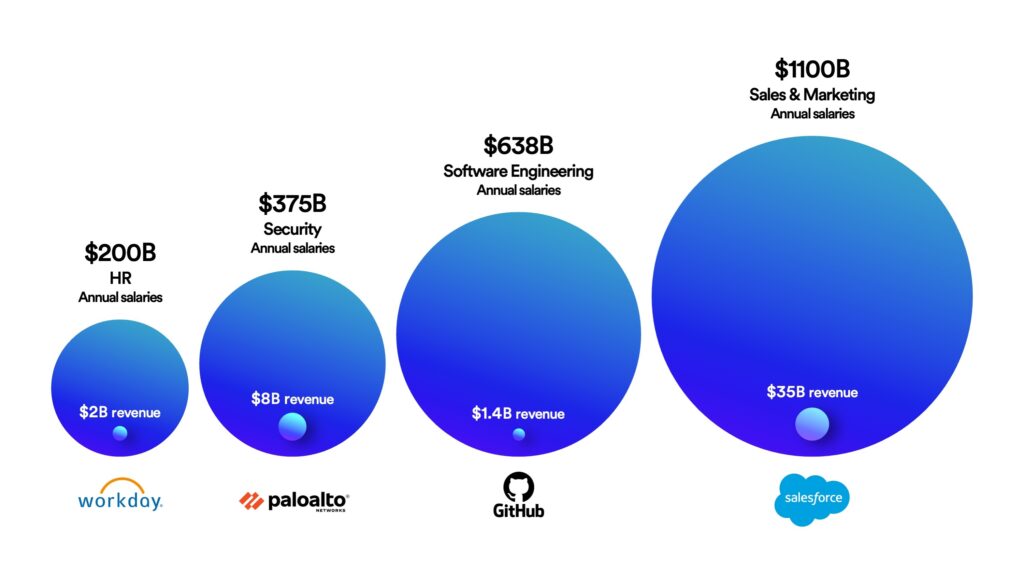

The AI Talent War and Salary Inflation: A small, global pool of top-tier AI researchers and engineers can command annual compensation packages in the millions of dollars. Tech giants and well-funded startups are engaged in a fierce bidding war for this talent, leading to extreme salary inflation that makes building a team prohibitively expensive for all but the best-capitalized players. The “brain drain” from academia to industry further exacerbates this shortage.

B. The Uncertain Revenue Models: How Will AI Make Money?

On the other side of the colossal cost equation is the equally challenging question of revenue. The industry is still experimenting with business models, and none have yet proven to be a silver bullet for sustainable, large-scale profitability.

B.1. The Dominant Models and Their Limitations

Several revenue generation strategies are currently being deployed, each with its own set of constraints.

-

The Subscription Model (B2C and B2B): This is the approach of OpenAI with ChatGPT Plus and Microsoft with Copilot for Microsoft 365.

-

Pros: Provides predictable recurring revenue and directly monetizes heavy users.

-

Cons: Faces consumer price sensitivity and risks hitting a growth ceiling. There is a constant pressure to deliver enough perceived value to justify the ongoing monthly or annual fee, especially when capable free tiers exist.

-

-

The API-Based Model (Platform Play): Companies like OpenAI and Anthropic sell access to their AI models via an API, charging per token (a unit of text).

-

Pros: Allows them to capture value from a vast ecosystem of third-party applications and developers.

-

Cons: This is a low-margin, volume-driven business that directly ties revenue to the high inference costs mentioned earlier. It also faces intense pressure from competitors and the constant risk of customers switching to a cheaper or more powerful alternative.

-

-

The Advertising-Supported Model: Google and Meta are integrating AI into their existing advertising empires.

-

Pros: Leverages a proven, high-margin business model they have already mastered.

-

**Cons: AI-generated answers can potentially reduce click-through rates to publisher websites, undermining the very ecosystem that feeds the ad model. There are also significant challenges in effectively placing ads within conversational AI interfaces without degrading the user experience.

-

B.2. The Enterprise Solution Sales Model

Many see the enterprise sector as the most promising path to profitability.

-

The Value Proposition: Selling AI as a tool to automate complex workflows, enhance customer service with intelligent chatbots, or accelerate software development promises a clear return on investment (ROI) that businesses are willing to pay for.

-

The Challenges: Enterprise sales cycles are long and expensive. Solutions often require significant customization, integration, and ongoing support, which further erodes margins. Additionally, large corporations have stringent data security, privacy, and compliance requirements that can be difficult and costly to meet.

C. The Looming Threats to Long-Term Profitability

Even if a company navigates the cost and revenue challenges, several structural threats loom on the horizon that could permanently suppress profitability across the industry.

C.1. The Commoditization Trap

As AI technology matures, it risks becoming a ubiquitous and undifferentiated utility.

-

The “Race to the Bottom”: If multiple companies offer AI models with similar capabilities, competition will inevitably shift to price. This could trigger a brutal price war, similar to what happened in the cloud computing market, squeezing margins for all players and making it impossible to recoup the massive upfront investments.

-

The Open-Source Disruption: The proliferation of powerful, open-source AI models (like Meta’s LLaMA series) allows anyone to use and modify advanced AI without paying licensing fees. While these may not always be state-of-the-art, they are “good enough” for many applications, creating a powerful, free alternative that caps the pricing power of commercial AI providers.

C.2. The Legal and Regulatory Quagmire

The legal foundation upon which many AI models are built is looking increasingly unstable.

-

Copyright and Intellectual Property Lawsuits: AI companies are facing a wave of high-stakes lawsuits from content creators, publishers, and artists alleging that their copyrighted works were used without permission or compensation to train models. A series of adverse court rulings could lead to crippling liabilities, forced licensing fees, or even mandates to destroy trained models—a financial catastrophe of unprecedented scale.

-

The Rising Tide of Global Regulation: Governments in the EU, the US, and elsewhere are drafting comprehensive AI regulations focused on transparency, bias, and safety. Compliance with these complex and potentially conflicting regulatory regimes will add significant operational costs and legal overhead, further impacting the bottom line.

C.3. The Technical Debt and Innovation Treadmill

The breakneck speed of AI development creates its own set of economic problems.

-

The Cost of Obsolescence: A model that is state-of-the-art today may be rendered obsolete by a new architectural breakthrough in a matter of months. Companies are trapped on an innovation treadmill, forced to continuously invest billions in R&D to retrain and improve their models just to maintain competitive parity, with no guarantee that the next generation will be significantly more profitable.

-

Mounting Technical Debt: The pressure to ship new features quickly often leads to the accumulation of “technical debt”—shortcuts and suboptimal code that makes systems harder to maintain and more expensive to operate in the long run. Paying down this debt requires significant re-engineering efforts that divert resources from new development.

Conclusion: The Inevitable Shakeout and the Search for Durable Value

The current state of the AI industry is a high-stakes gamble. Venture capital and corporate balance sheets are funding a land grab, betting that future revenues will eventually dwarf today’s eye-watering costs. However, the fundamental laws of economics have not been suspended. The industry is heading towards an inevitable and painful shakeout.

The companies that ultimately solve the billion-dollar profitability puzzle will likely be those that can successfully do one or more of the following: achieve unassailable scale and efficiency in their compute infrastructure; build a deeply integrated and “sticky” ecosystem that locks in customers (like Microsoft); develop highly specialized, vertical-specific AI solutions that command premium pricing; or navigate the legal and regulatory landscape more adeptly than their rivals. They will also need to demonstrate a clear, measurable, and defensible return on investment that justifies the ongoing cost.

The AI gold rush is real, but the true fortune will not be made by those who simply mine the ore (build the models). It will be made by those who master the economics of the entire operation—from the supply chain of chips and data to the final delivery of indispensable value to the customer. The billion-dollar question remains unanswered, and the race to solve it is the most important competition in technology today.

Tags: AI profitability, AI business models, cost of AI, generative AI economics, AI compute costs, AI as a service, AI licensing, AI market trends, sustainable AI, AI investment