The Unlikely New Tech Leader Emerges

For decades, the narrative of global technology leadership followed a predictable script. Silicon Valley was the undisputed epicenter, with its venture capital-fueled startups and established titans like Apple, Google, and Meta defining the future. This model, built on consumer software, social networks, and advertising, seemed unassailable. However, a profound and unexpected power shift is now underway. The new leader in the technology race is not a flashy startup from a California garage, but a company that has quietly mastered the unglamorous, capital-intensive, and physically demanding foundation of the digital world: hardware and infrastructure. This unexpected vanguard is NVIDIA, a company that began its life focused on gaming graphics and has now become the most critical enabler of the artificial intelligence revolution. Its ascent signals a fundamental change in what constitutes technological leadership, moving from consumer-facing applications to the underlying computational engines that power them, and heralding a new era where the companies that build the picks and shovels hold more power than those panning for gold.

A. The Foundation of the New Leadership: Mastering the Silicon Engine

NVIDIA’s rise was not an accident but the result of a prescient, decades-long bet on a specific type of computing that would become the lifeblood of modern AI.

A.1. The GPU: From Gaming to AI Supercomputing

The Graphics Processing Unit (GPU) is the cornerstone of NVIDIA’s dominance. Its architecture is uniquely suited for the computational demands of the 21st century.

-

Parallel Processing Prowess: Unlike a Central Processing Unit (CPU), which is designed for sequential tasks, a GPU contains thousands of smaller, efficient cores designed to perform multiple calculations simultaneously. This parallel architecture is perfectly suited for the matrix and vector operations that are fundamental to training neural networks, the technology behind all modern AI.

-

The CUDA Software Moat: NVIDIA’s masterstroke was not just hardware; it was the creation of CUDA (Compute Unified Device Architecture), a parallel computing platform and programming model. CUDA allowed developers to harness the power of GPUs for general-purpose processing (GPGPU), turning them from specialized graphics cards into versatile supercomputing engines. This created a powerful software ecosystem and developer loyalty that competitors are still struggling to match.

-

The AI Training Imperative: When researchers discovered that NVIDIA’s GPUs could train deep learning models orders of magnitude faster than CPUs, the company’s fate was sealed. It became the de facto standard for every AI lab and tech giant in the world, creating an insatiable demand for its chips.

A.2. The Full-Stack Platform Strategy: Beyond Selling Chips

NVIDIA’s true genius lies in its evolution from a component supplier to a full-stack platform company.

-

Building the AI Factory Stack: NVIDIA no longer just sells GPUs. It sells complete, optimized systems like the DGX (for AI training) and HGX (for hyperscale computing) that integrate its hardware, networking, and software into a turnkey AI solution. This provides unparalleled performance and ease of use, locking customers into its ecosystem.

-

Software and Libraries: With platforms like NVIDIA AI Enterprise, which includes pre-trained models, frameworks, and optimization tools, the company provides the entire software layer needed to build and deploy AI applications, making its hardware even more indispensable.

-

The Networking Advantage: The acquisition of Mellanox in 2019 gave NVIDIA a dominant position in high-speed networking interconnects, which are critical for linking thousands of GPUs together to form a single, massive AI supercomputer. This vertical integration creates a seamless, high-performance package that is incredibly difficult to compete with.

B. The Contenders: Why Traditional Tech Giants Are Playing Catch-Up

The surprise of NVIDIA’s leadership is highlighted by the relative positions of the former titans, who are now heavily dependent on its technology.

B.1. The Cloud Hyperscalers: Dependent and Competing

Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are the landlords of the digital economy, but they all rely on NVIDIA to power their most advanced services.

-

The Provider-Client Paradox: These cloud giants are both NVIDIA’s biggest customers, purchasing billions of dollars in GPUs, and its nascent competitors, developing their own custom AI chips (like Google’s TPU, AWS’s Trainium, and Microsoft’s Maia).

-

The Insurmountable Lead: However, they are years behind NVIDIA’s integrated hardware-software stack and face the immense challenge of convincing developers to adopt their proprietary architectures over the industry-standard CUDA ecosystem. Their primary role, for the foreseeable future, is to provide access to NVIDIA’s hardware for their customers.

B.2. The Consumer Tech Giants: Software in Search of Hardware

Companies like Meta and Apple have different challenges in this new landscape.

-

Meta’s AI Ambitions: Meta’s future, including its massive bet on the metaverse and its generative AI initiatives, is entirely dependent on building vast AI supercomputers powered by hundreds of thousands of NVIDIA H100 GPUs. Its strategic direction is literally constrained by its ability to acquire enough of NVIDIA’s chips.

-

Apple’s Integrated Model: Apple has long excelled at designing its own silicon for its devices (the M-series chips). However, its focus has been on power efficiency for consumer devices. It remains to be seen if it can scale this expertise to compete with NVIDIA in the data center and AI training space, where raw computational throughput is the primary metric.

C. The Global Geopolitical Dimension: A New Center of Power

NVIDIA’s dominance has thrust it into the center of global geopolitics, making it a strategic asset whose products are subject to international export controls.

C.1. The Taiwan Semiconductor Manufacturing Company (TSMC) Symbiosis

NVIDIA’s success is inextricably linked to another unexpected leader: TSMC. This Taiwanese company’s mastery of advanced semiconductor manufacturing is the only thing that can physically build NVIDIA’s most complex designs.

-

A Duopoly of Necessity: NVIDIA designs the chips, and TSMC manufactures them. This symbiotic relationship highlights that technological leadership is now distributed across a global supply chain, with choke points that have immense strategic importance.

-

Geopolitical Fragility: The concentration of advanced chip manufacturing in Taiwan creates a massive global economic and security risk. This has triggered massive government investments in alternative manufacturing hubs, such as the U.S. CHIPS and Science Act, but catching up to TSMC will take years, if not decades.

C.2. The Pivot to a “Sovereign AI” Future

NVIDIA’s CEO, Jensen Huang, has begun articulating a vision for “Sovereign AI,” where nations will seek to develop and control their own AI capabilities using their unique cultural data.

-

The Implication: This vision positions NVIDIA as the essential partner to every government in the world, providing the infrastructure needed for national AI sovereignty. This elevates the company from a mere tech supplier to a key player in national security and economic development for countries across the globe.

D. The Sustainability of Leadership: Challenges on the Horizon

No leadership position is permanent, especially in technology. NVIDIA faces several formidable challenges that could disrupt its reign.

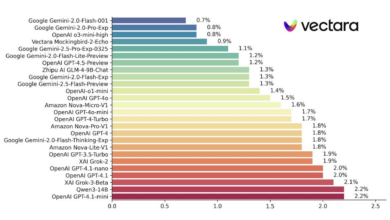

D.1. The Competitive Threat: A Determined Assault on the Moat

The entire tech industry is motivated to break its dependency on NVIDIA.

-

The Rise of Alternative Architectures: Competitors like AMD are launching powerful GPUs (MI300 series) and working on their own software ecosystems (ROCm) to challenge CUDA’s dominance. While still playing catch-up, they are making significant progress.

-

The Custom Silicon Movement: As mentioned, the cloud hyperscalers are designing their own AI chips. While these may not replace NVIDIA for all tasks, they can capture a significant portion of the market for specific, optimized workloads, chipping away at NVIDIA’s growth.

-

The Open-Source and Software Challenge: The growing maturity of open-source machine learning frameworks (like PyTorch) could, over time, reduce the lock-in power of CUDA, making it easier for developers to switch to alternative hardware.

D.2. Market Dynamics and the End of the AI Hype Cycle

NVIDIA’s valuation is predicated on continued, explosive growth in AI spending.

-

The Capital Expenditure Cycle: If the ROI from massive AI investments fails to materialize for its customers (other tech companies), their spending on NVIDIA hardware will slow, impacting NVIDIA’s revenue growth.

-

The Question of Saturation: How many data centers need to be filled with the latest GPUs? There may be a natural saturation point, or a shift towards more efficient, specialized chips that could change the demand dynamics.

Conclusion: The New Blueprint for Tech Dominance

NVIDIA’s ascent as the unexpected leader in technology provides a new blueprint for what it takes to lead in the 21st century. It demonstrates that foundational, deep-tech innovation in hardware and infrastructure can be more valuable and defensible than building consumer software applications. Leadership is no longer just about owning the user interface, but about controlling the core computational engine that powers the global economy.

This shift has profound implications. It suggests that future tech leaders will likely emerge from domains like quantum computing, biotechnology, or energy storage—fields that require deep scientific expertise and capital-intensive R&D. The era of the “asset-light” software company as the default leader may be waning. NVIDIA’s story is a powerful reminder that while everyone looks for the next big app, the greatest power and value often lie in building the tools that make the next big app possible. The tech world has a new leader, and its foundation is not in code, but in silicon.

Tags: NVIDIA dominance, AI hardware leader, GPU computing, Jensen Huang, tech industry shift, semiconductor leadership, AI infrastructure, CUDA platform, sovereign AI, tech stock performance