Why Nvidia’s Stock Skyrocketed Recently

Introduction: The Meteoric Ascent of a Silicon Valley Titan

In the annals of stock market history, few stories are as dramatic and consequential as the recent surge of Nvidia Corporation (NVDA). What was once primarily known as a manufacturer of powerful graphics cards for PC gamers has transformed into the most pivotal company of the artificial intelligence era, a transformation reflected in its staggering market valuation. This isn’t a simple tale of a company selling more products; it’s a narrative about becoming the absolute cornerstone of a technological revolution. Nvidia’s stock surge is a direct proxy for the world’s accelerating adoption of AI. This in-depth analysis will dissect the multifaceted engine behind Nvidia’s historic rally, exploring the perfect storm of technological dominance, strategic foresight, and macroeconomic forces that have positioned this chipmaker as the undisputed king of the new computing age.

A. The AI Paradigm Shift: From Gaming to the Foundation of Modern Computing

To understand Nvidia’s rise, one must first understand the fundamental shift in computing. For decades, the central processing unit (CPU), dominated by Intel, was the heart of computation. However, the AI revolution, specifically the field of deep learning, requires a different kind of processing power.

A. The GPU as the AI Engine: A Parallel Processing Powerhouse

* CPUs vs. GPUs: A CPU is like a Swiss Army knife—versatile and excellent for handling a wide variety of tasks one after another (sequentially). A Graphics Processing Unit (GPU), however, is like a massive army of chefs in a kitchen, all working on the same recipe simultaneously. It is designed for parallel processing, performing thousands of simple calculations at the same time.

* Why AI Loves Parallelism: Training large AI models, like the neural networks behind ChatGPT or Midjourney, involves performing mathematical operations on enormous matrices (grids of numbers). This is a task perfectly suited for the parallel architecture of a GPU. What might take a CPU weeks to compute can be accomplished by a GPU in days or even hours.

B. CUDA: The Software Moat That Locked In Dominance

Nvidia’s true genius wasn’t just building powerful hardware; it was creating an entire ecosystem around it. In 2006, Nvidia introduced CUDA (Compute Unified Device Architecture), a parallel computing platform and programming model that allows developers to use Nvidia GPUs for general-purpose processing (GPGPU).

* Creating a Developer Ecosystem: CUDA gave software developers the tools to easily harness the raw power of Nvidia’s GPUs for non-graphical tasks, including scientific simulations, financial modeling, and crucially, AI and deep learning.

* The Self-Reinforcing Flywheel: Over more than a decade, a vast global community of researchers and developers has built an immense body of code, libraries, and frameworks (like TensorFlow and PyTorch) exclusively on top of CUDA. This created a powerful software moat. Switching to a competitor’s hardware would mean abandoning this colossal software investment, making Nvidia’s chips the default and deeply entrenched standard for AI development.

B. The Data Center Gold Rush: Fueling the AI Infrastructure Boom

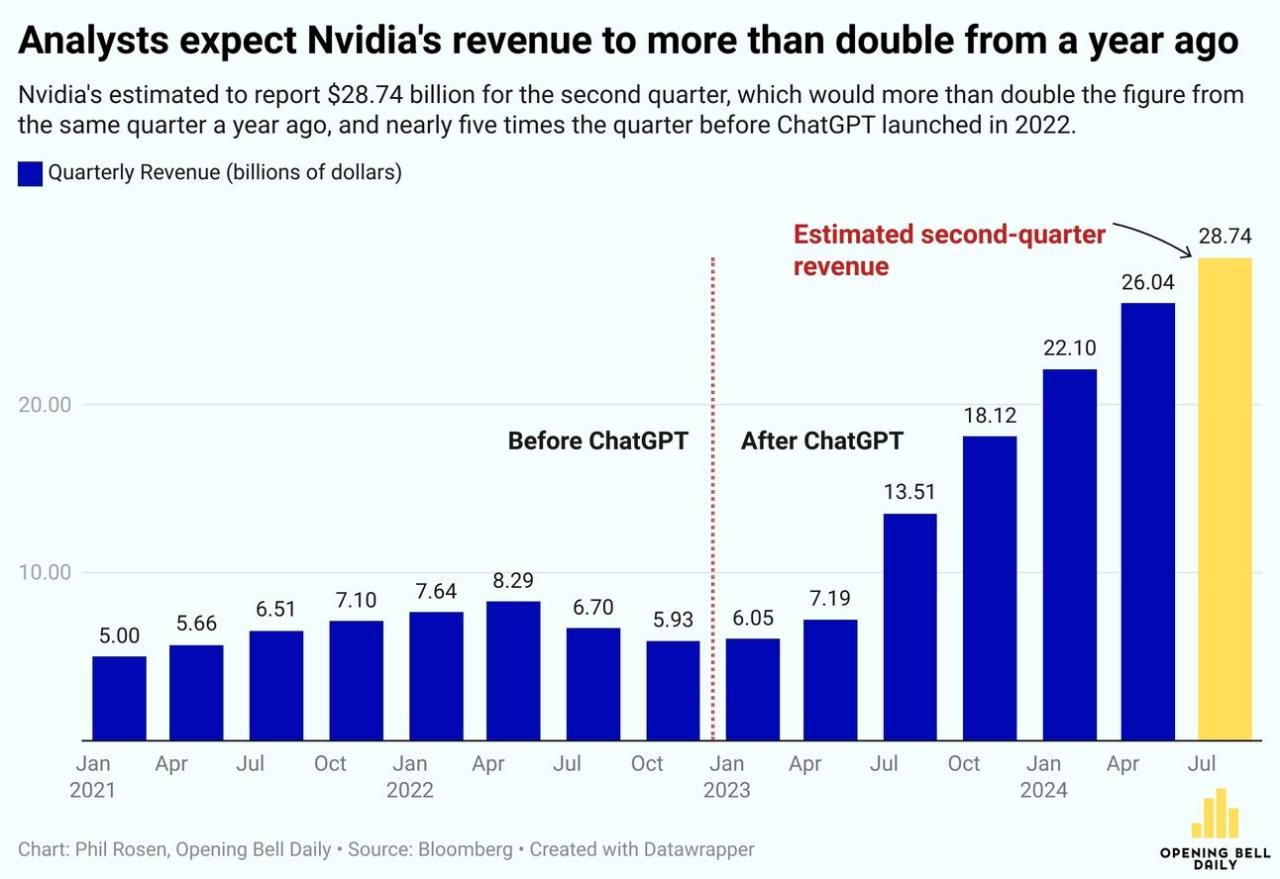

While gaming provided the initial runway, the data center business has been the rocket fuel for Nvidia’s stock. As every major tech company raced to build and deploy AI, they all needed the same thing: Nvidia’s data center GPUs.

A. The Insatiable Demand from Cloud Giants and Hyperscalers

Companies like Microsoft (for OpenAI), Google, Amazon (AWS), and Meta are engaged in an all-out AI arms race. They are spending tens of billions of dollars to build out their AI cloud infrastructure, and the foundational component of these investments is the Nvidia GPU.

* The H100 and Blackwell Architectures: Nvidia’s data center GPUs, like the previous-generation A100 and the current flagship H100, are specifically designed for AI training and inference. They are not just chips but full systems (GPUs, networking, software) that offer unparalleled performance. The announcement of the next-generation Blackwell platform, promising another massive leap in performance, only solidified investor confidence in Nvidia’s continued leadership.

* Revenue Explosion: Nvidia’s Data Center segment revenue grew from a few billion dollars annually to over $47 billion in its last fiscal year, a meteoric rise that directly correlates with the AI boom and far surpassed all Wall Street expectations.

B. The Full-Stack Solution: Beyond the Chip

Nvidia’s strategy evolved from selling discrete components to providing a full-stack, end-to-end platform. This includes:

* Networking: Their Mellanox networking technology creates high-speed, low-latency connections between thousands of GPUs, essential for building the AI supercomputers that tech giants are deploying.

* Software and Services: Platforms like Nvidia AI Enterprise and DGX Cloud provide the software layer and even cloud-based access to their hardware, creating recurring revenue streams and deepening customer reliance on the Nvidia ecosystem.

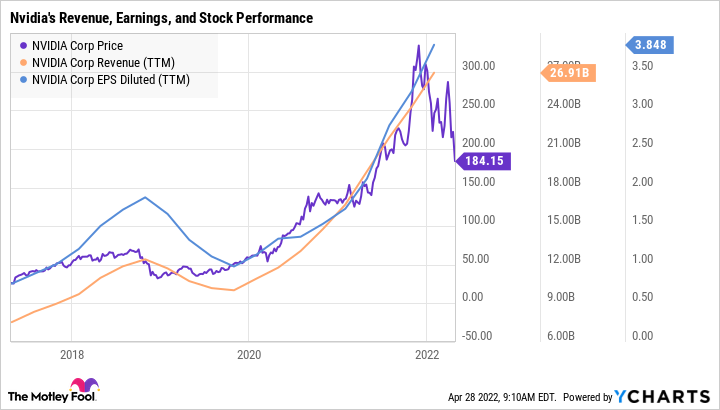

C. The Financial Performance: Shattering Every Expectation

The stock market is a forward-looking mechanism, and Nvidia’s financial results have consistently not just met but dramatically exceeded even the most optimistic projections.

A. Record-Shattering Earnings Reports: For multiple consecutive quarters, Nvidia announced revenue and profit figures that stunned analysts. Guidance for future quarters was often raised so significantly that it represented a “wave of demand” that the market had not fully anticipated. Each earnings report became a major market event, often lifting the entire technology sector.

B. Explosive Profit Margins: Due to its technological dominance and lack of viable competition at scale, Nvidia commands exceptional pricing power. Its gross margins expanded dramatically, demonstrating that it was not just selling more units, but selling them at highly profitable rates. This combination of hyper-growth and expanding margins is the holy grail for investors.

C. The Stock Split and Retail Accessibility: In 2024, Nvidia executed a 10-for-1 stock split. While a split does not change the fundamental value of the company, it made the share price more psychologically accessible to a broader base of retail investors, increasing liquidity and demand, which provided an additional tailwind for the stock price.

D. The “One-Stop-Shop” Effect and TAM Expansion

Nvidia has successfully positioned itself as the essential provider for multiple, simultaneous technological megatrends, vastly expanding its Total Addressable Market (TAM).

A. Beyond AI Model Training: The Inference Opportunity

While training massive AI models is the initial burst of demand, the longer-term, potentially larger market is in AI inference—the process of using a trained model to make predictions or generate content (like running ChatGPT). As thousands of companies integrate AI into their applications, the demand for inference compute power will be immense, and Nvidia’s hardware is poised to capture a massive share of this market.

B. Autonomous Vehicles and Robotics: The Nvidia Drive platform is a leading solution for the compute-intensive needs of self-driving cars, another field reliant on AI and parallel processing.

C. Omniverse and Digital Twins: Nvidia is pioneering the concept of industrial metaverses with its Omniverse platform, a system for creating and operating digital twins of factories, cities, and even physical processes. This represents a entirely new, multi-billion dollar market frontier.

E. The Competitive Landscape: A Moat Without a Challenger

A key driver of investor confidence is the lack of a immediate, credible threat to Nvidia’s dominance.

A. The Struggles of Traditional Competitors: AMD, while a formidable competitor in CPUs and gaming GPUs, is still playing catch-up in the AI data center space. Its software ecosystem (ROCm) is not as mature or widely adopted as Nvidia’s CUDA, creating a significant barrier for customers.

B. The In-House Chip Efforts: A Validation, Not a Threat: Tech giants like Google (TPU), Amazon (Trainium), and Microsoft are developing their own custom AI chips. However, these are largely focused on optimizing their own specific workloads (like inference) and are not broad-scale replacements for the versatility and performance of Nvidia’s full stack. In many ways, these efforts validate the critical importance of specialized AI silicon—a market Nvidia still dominates.

F. Macroeconomic and Market Dynamics

Broader market conditions have also played a role in Nvidia’s ascent.

A. The “Flight to Quality” in Tech: In an uncertain economic environment, investors tend to flock to companies with undeniable growth, strong balance sheets, and a clear leadership position. Nvidia became the quintessential “flight to quality” stock within the tech sector.

B. The Narrative of “The Next Cisco or Intel”: Nvidia is often compared to Cisco during the dot-com boom, which provided the networking “picks and shovels” for the internet. Similarly, it’s seen as the modern equivalent of Intel during the PC era. This powerful narrative attracts investors who want to own the foundational infrastructure of a transformative technological shift.

G. Risks and Considerations for the Future

While the trajectory has been spectacular, no investment is without risk.

A. Customer Concentration and the Cyclical Nature of Capex: A significant portion of Nvidia’s data center revenue comes from a handful of large cloud providers. If these companies were to significantly slow their AI infrastructure spending, it would materially impact Nvidia’s growth.

B. Geopolitical Tensions and Export Controls: Restrictions on selling advanced AI chips to certain markets, particularly China, present a headwind and have forced Nvidia to create modified, less-powerful chips for these regions, potentially ceding market share.

C. The Long-Term Threat of Competition and Technological Shifts: While the moat is wide, it is not unassailable. Continued efforts from AMD, the rise of open-source software alternatives, or a fundamental shift in AI architecture that diminishes the need for GPU-style processing could challenge Nvidia’s long-term dominance.

Conclusion: More Than a Stock, A Bet on the Future Itself

Nvidia’s stock surge is a phenomenon that transcends typical market dynamics. It is the financial market’s unequivocal verdict that artificial intelligence is the most transformative technological force of our time, and it has anointed Nvidia as the company that is building its foundation. Under the visionary leadership of CEO Jensen Huang, Nvidia executed a long-term strategy that perfectly positioned it to capitalize on a wave of demand it helped to create. Its combination of unassailable hardware, a critical software ecosystem, and a full-stack platform approach has created a virtuous cycle of innovation, demand, and financial performance. Investing in Nvidia has become, for many, a direct proxy for investing in the future of AI. While the road ahead will inevitably have bumps, the company’s historic rally is a testament to its central role in powering the next chapter of human technological progress.